All Categories

Featured

Table of Contents

On the other hand, if a client needs to offer an unique needs youngster who might not have the ability to manage their own cash, a trust can be included as a recipient, allowing the trustee to manage the distributions. The kind of beneficiary an annuity proprietor selects influences what the recipient can do with their acquired annuity and just how the proceeds will be taxed.

Lots of agreements allow a spouse to determine what to do with the annuity after the owner dies. A spouse can change the annuity agreement into their name, thinking all guidelines and rights to the initial arrangement and delaying immediate tax obligation repercussions (Immediate annuities). They can gather all remaining repayments and any survivor benefit and choose beneficiaries

When a spouse comes to be the annuitant, the partner takes control of the stream of repayments. This is called a spousal extension. This provision enables the making it through spouse to keep a tax-deferred status and protected long-term monetary stability. Joint and survivor annuities likewise enable a named beneficiary to take over the agreement in a stream of repayments, instead of a lump amount.

A non-spouse can just access the marked funds from the annuity owner's initial arrangement. Annuity owners can pick to designate a trust as their recipient.

What is an Deferred Annuities?

These differences assign which beneficiary will certainly receive the entire fatality advantage. If the annuity owner or annuitant dies and the main beneficiary is still to life, the main beneficiary receives the death benefit. Nevertheless, if the main recipient predeceases the annuity owner or annuitant, the survivor benefit will certainly go to the contingent annuitant when the owner or annuitant passes away.

The proprietor can transform recipients at any moment, as long as the agreement does not need an irreversible recipient to be called. According to professional factor, Aamir M. Chalisa, "it is very important to recognize the relevance of assigning a beneficiary, as choosing the wrong beneficiary can have major repercussions. Numerous of our clients choose to call their underage kids as beneficiaries, often as the main beneficiaries in the lack of a partner.

Proprietors who are married must not presume their annuity automatically passes to their partner. Frequently, they go through probate first. Our short test provides clearness on whether an annuity is a smart selection for your retired life portfolio. When selecting a beneficiary, take into consideration aspects such as your partnership with the person, their age and exactly how acquiring your annuity might impact their financial situation.

The beneficiary's partnership to the annuitant generally figures out the rules they comply with. A spousal recipient has more options for dealing with an acquired annuity and is treated even more leniently with taxes than a non-spouse recipient, such as a youngster or various other family participant. Mean the owner does decide to name a kid or grandchild as a beneficiary to their annuity

Are Annuity Contracts a safe investment?

In estate planning, a per stirpes designation specifies that, needs to your beneficiary die prior to you do, the recipient's offspring (youngsters, grandchildren, et cetera) will receive the death benefit. Connect with an annuity professional. After you've chosen and called your beneficiary or beneficiaries, you need to remain to evaluate your choices at the very least annually.

Keeping your designations up to day can guarantee that your annuity will be managed according to your desires need to you pass away unexpectedly. A yearly review, major life occasions can prompt annuity owners to take another appearance at their beneficiary selections.

Lifetime Payout Annuities

Similar to any type of financial item, seeking the aid of an economic consultant can be valuable. A financial organizer can direct you with annuity management procedures, including the approaches for updating your agreement's recipient. If no beneficiary is named, the payout of an annuity's survivor benefit goes to the estate of the annuity holder.

To make Wealthtender totally free for readers, we earn cash from marketers, including economic specialists and companies that pay to be included. This creates a conflict of rate of interest when we favor their promotion over others. Review our content plan and regards to service for more information. Wealthtender is not a client of these financial providers.

As a writer, it is among the ideal compliments you can give me. And though I really value any one of you spending some of your hectic days reviewing what I create, clapping for my short article, and/or leaving appreciation in a comment, asking me to cover a topic for you truly makes my day.

It's you stating you trust me to cover a subject that is essential for you, and that you're positive I would certainly do so better than what you can currently locate online. Pretty heady stuff, and a duty I do not take likely. If I'm not aware of the subject, I research it on-line and/or with contacts that know even more concerning it than I do.

What is the best way to compare Lifetime Income Annuities plans?

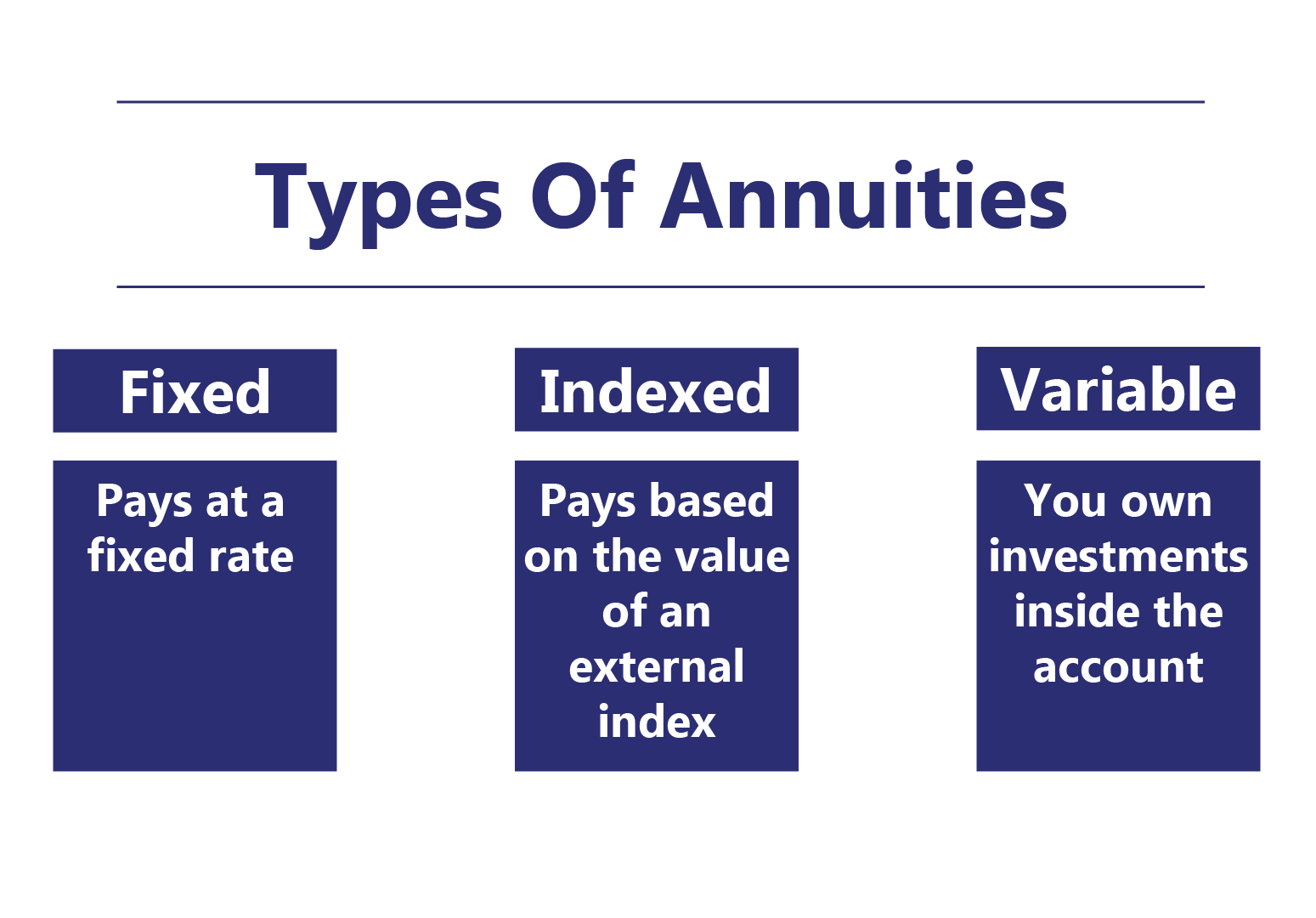

Are annuities a valid suggestion, an intelligent step to safeguard guaranteed revenue for life? In the most basic terms, an annuity is an insurance item (that just certified representatives might market) that assures you regular monthly repayments.

This usually uses to variable annuities. The even more cyclists you tack on, and the less threat you're ready to take, the reduced the payments you must anticipate to obtain for a provided premium.

How do I receive payments from an Annuity Income?

Annuities chose appropriately are the appropriate choice for some individuals in some situations. The only means to know for certain if that includes you is to first have a detailed economic strategy, and after that find out if any type of annuity option supplies sufficient benefits to justify the costs. These expenses consist of the bucks you pay in costs obviously, yet likewise the possibility expense of not spending those funds in different ways and, for most of us, the influence on your ultimate estate.

Charles Schwab has a clever annuity calculator that shows you approximately what settlements you can expect from dealt with annuities. I utilized the calculator on 5/26/2022 to see what an immediate annuity may payment for a single premium of $100,000 when the insured and spouse are both 60 and live in Maryland.

Table of Contents

Latest Posts

Exploring Fixed Index Annuity Vs Variable Annuities Everything You Need to Know About Annuities Fixed Vs Variable Defining Fixed Vs Variable Annuity Pros and Cons of Fixed Vs Variable Annuity Pros Con

Understanding Fixed Vs Variable Annuity Pros And Cons A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Variable Annui

Decoding How Investment Plans Work Everything You Need to Know About Fixed Annuity Or Variable Annuity What Is Variable Annuity Vs Fixed Indexed Annuity? Advantages and Disadvantages of Different Reti

More

Latest Posts