All Categories

Featured

Table of Contents

For those ready to take a bit much more threat, variable annuities offer extra chances to grow your retirement possessions and potentially increase your retirement earnings. Variable annuities provide a variety of investment choices looked after by professional money managers. Consequently, capitalists have much more flexibility, and can also relocate properties from one choice to one more without paying tax obligations on any type of investment gains.

* An instant annuity will not have a buildup stage. Variable annuities provided by Safety Life Insurance Business (PLICO) Nashville, TN, in all states except New york city and in New York by Protective Life & Annuity Insurer (PLAIC), Birmingham, AL. Securities offered by Financial investment Distributors, Inc. (IDI). IDI is the major expert for registered insurance policy products released by PLICO and PLAICO, its affiliates.

Capitalists need to meticulously consider the financial investment objectives, threats, fees and expenses of a variable annuity and the underlying investment alternatives before investing. This and various other information is consisted of in the syllabus for a variable annuity and its underlying investment choices. Prospectuses may be acquired by contacting PLICO at 800.265.1545. An indexed annuity is not a financial investment in an index, is not a protection or securities market financial investment and does not join any stock or equity investments.

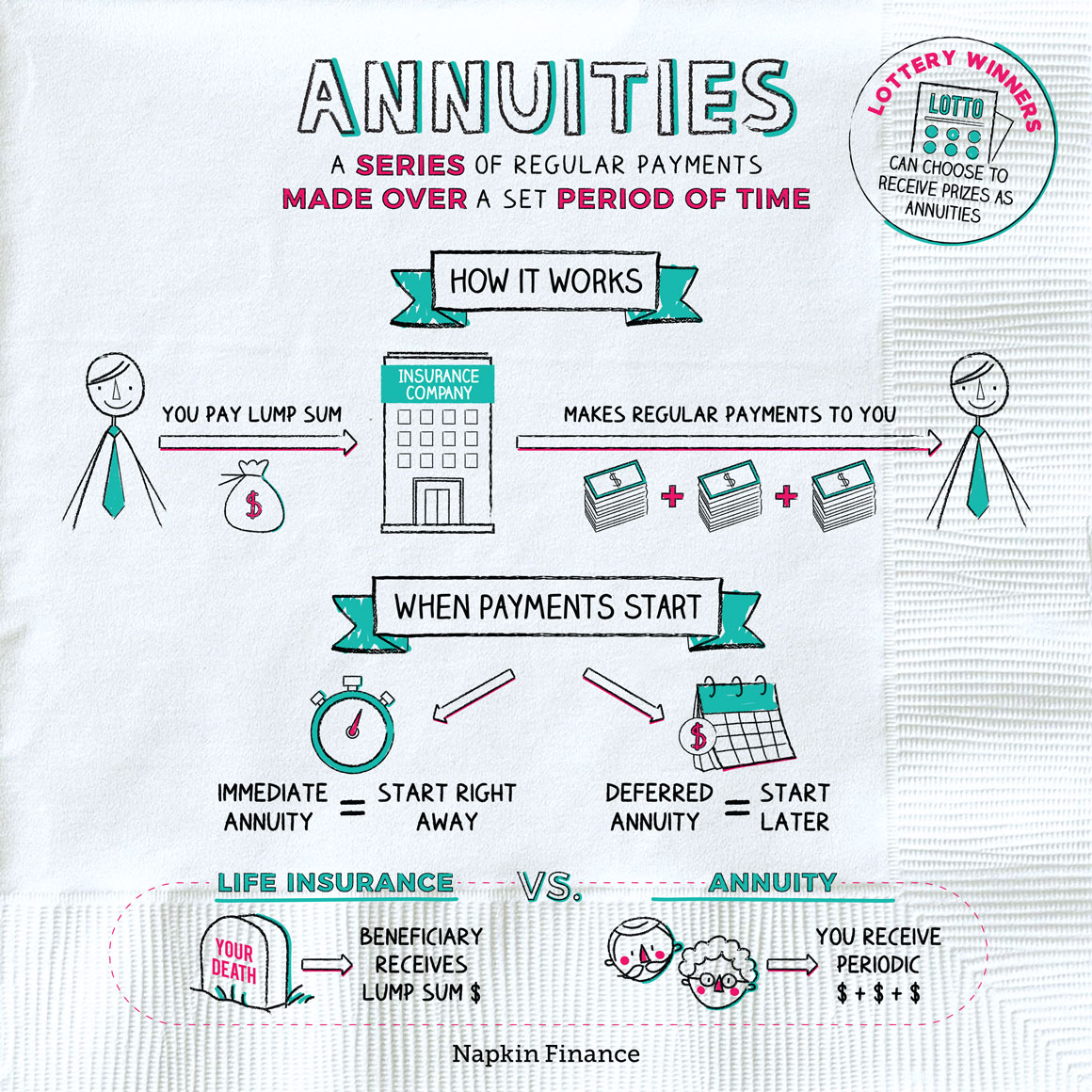

What's the distinction in between life insurance policy and annuities? It's an usual concern. If you question what it requires to protect a financial future on your own and those you love, it might be one you find yourself asking. Which's an excellent point. The lower line: life insurance policy can aid provide your enjoyed ones with the financial comfort they should have if you were to die.

What are the top Annuity Withdrawal Options providers in my area?

Both must be considered as component of a long-lasting monetary plan. Both share some similarities, the general purpose of each is very various. Allow's take a glimpse. When contrasting life insurance policy and annuities, the biggest difference is that life insurance policy is created to assist protect versus a monetary loss for others after your fatality.

If you wish to learn even much more life insurance, checked out the specifics of just how life insurance policy works. Consider an annuity as a device that could assist fulfill your retirement demands. The primary function of annuities is to produce revenue for you, and this can be done in a couple of different means.

What are the benefits of having an Guaranteed Income Annuities?

There are many prospective benefits of annuities. Some consist of: The ability to expand account worth on a tax-deferred basis The possibility for a future income stream that can not be outlived The possibility of a round figure benefit that can be paid to a surviving partner You can acquire an annuity by offering your insurance provider either a single lump amount or making repayments with time.

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Individuals normally get annuities to have a retirement revenue or to develop savings for an additional function. You can get an annuity from an accredited life insurance policy representative, insurance provider, economic planner, or broker. You need to talk with a monetary consultant concerning your demands and goals prior to you purchase an annuity.

How can an Long-term Care Annuities protect my retirement?

The distinction in between both is when annuity payments start. enable you to conserve money for retirement or other reasons. You don't have to pay taxes on your incomes, or contributions if your annuity is a private retired life account (INDIVIDUAL RETIREMENT ACCOUNT), up until you withdraw the revenues. allow you to develop an earnings stream.

:max_bytes(150000):strip_icc()/present-value-annuity.asp-Final-7d2ae860c2b044069d77d5e626c5a6f3-72cf6d2c9f9041608b7cd343cbc3f2f4.png)

Deferred and instant annuities use a number of options you can choose from. The alternatives offer different degrees of potential threat and return: are assured to earn a minimum passion rate.

Variable annuities are greater risk because there's a chance you can shed some or all of your money. Set annuities aren't as dangerous as variable annuities since the financial investment danger is with the insurance firm, not you.

If efficiency is reduced, the insurer bears the loss. Set annuities assure a minimum rate of interest, generally between 1% and 3%. The firm could pay a greater rates of interest than the guaranteed rates of interest. The insurer determines the rates of interest, which can change regular monthly, quarterly, semiannually, or yearly.

Guaranteed Income Annuities

Index-linked annuities show gains or losses based upon returns in indexes. Index-linked annuities are extra complex than taken care of deferred annuities. It is very important that you understand the features of the annuity you're taking into consideration and what they imply. Both contractual functions that affect the quantity of interest credited to an index-linked annuity one of the most are the indexing technique and the participation rate.

Each relies upon the index term, which is when the firm calculates the rate of interest and credit histories it to your annuity. The figures out just how much of the increase in the index will certainly be used to determine the index-linked rate of interest. Other crucial functions of indexed annuities include: Some annuities top the index-linked interest rate.

Not all annuities have a floor. All fixed annuities have a minimal surefire value.

How does an Fixed Annuities help with retirement planning?

Other annuities pay substance passion throughout a term. Substance rate of interest is interest earned on the money you conserved and the passion you gain.

This percent could be made use of instead of or along with an engagement price. If you take out all your money prior to the end of the term, some annuities will not credit the index-linked passion. Some annuities could credit only component of the passion. The percent vested typically boosts as the term nears the end and is constantly 100% at the end of the term.

How do I cancel my Long-term Care Annuities?

This is because you bear the financial investment threat as opposed to the insurance business. Your representative or financial consultant can help you choose whether a variable annuity is ideal for you. The Securities and Exchange Commission categorizes variable annuities as safety and securities since the efficiency is obtained from supplies, bonds, and other financial investments.

Discover more: Retired life ahead? Think of your insurance. An annuity agreement has two phases: a build-up phase and a payout stage. Your annuity gains passion during the accumulation stage. You have a number of alternatives on exactly how you contribute to an annuity, depending upon the annuity you acquire: permit you to choose the time and amount of the settlement.

Table of Contents

Latest Posts

Understanding Fixed Vs Variable Annuity Pros And Cons A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Variable Annui

Decoding How Investment Plans Work Everything You Need to Know About Fixed Annuity Or Variable Annuity What Is Variable Annuity Vs Fixed Indexed Annuity? Advantages and Disadvantages of Different Reti

Exploring Fixed Annuity Vs Equity-linked Variable Annuity Key Insights on Annuities Variable Vs Fixed Defining Choosing Between Fixed Annuity And Variable Annuity Features of Variable Annuity Vs Fixed

More

Latest Posts